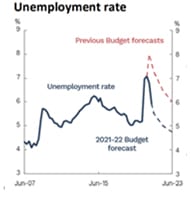

In his Budget speech, the Treasurer stated “Australia is coming back” with unemployment lower than pre pandemic levels (5.6%).

- The deficit, thanks in part to surging iron ore prices, is lower than anticipated in the 2020-21 Federal Budget at $161 billion in 2020-21, a $52.7 billion improvement to estimates.

- The underlying cash balance is expected to be a deficit of $106.6 billion in 2021-22 and continue to improve over the forward estimates to a deficit of $57 billion in 2024-25.

- While the deficit is large, it did its job.Real GDP grew strongly over the latter half of 2020, marking the first time on record when Australia has experienced two consecutive quarters of economic growth above 3% – output is expected to have exceeded its pre-pandemic level in the March quarter of 2021.

- Real GDP is forecast to grow by 25% in 2020-21, by 4.25% in 2021-22 and 2.5% in 2022-23. After falling by 2.5% in 2020, real GDP is expected to grow by 5.25% in 2021, and by 2.75% in 2022.

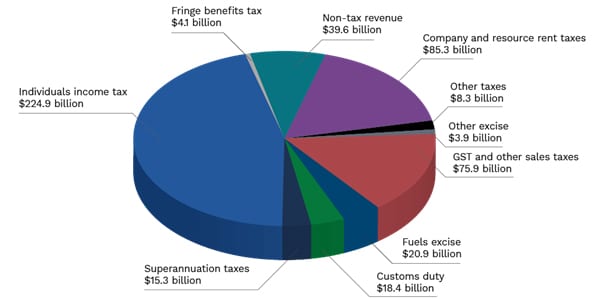

Revenue: Where 2021-22 Budget revenue comes from

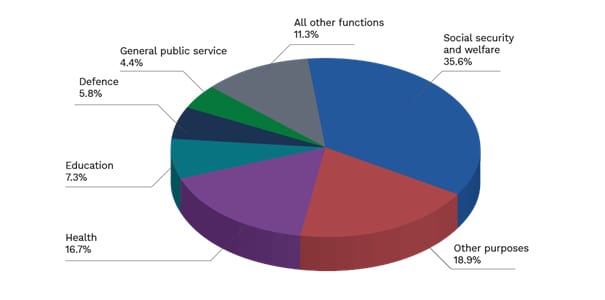

Expenditure: How the 2021-22 Budget is spent